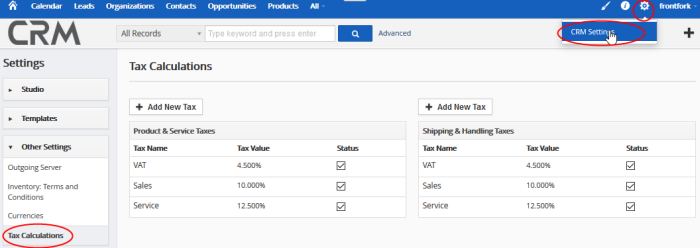

Manage Tax Calculations

The 'Tax Calculations' lets you set national and international tax rates to be applied to invoices, products, sales orders and purchase orders.

The taxes like VAT, sales and service taxes are default taxes that ship with Customer Relationship Management (CRM).

You can add a new taxes for 'Product & Services' and 'Shipping & Handling'.

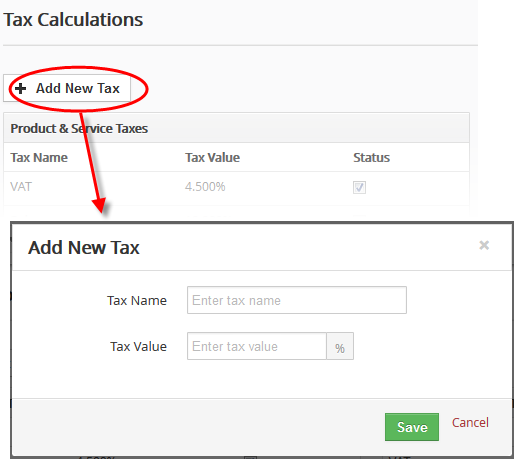

Add new tax

- Click the cog icon at top-right and open 'CRM Settings'

- Click 'Other Settings' > 'Tax Calculations'

- Click 'Add New Tax'

- Create a name for the tax and the tax's percentage. The figure you enter here will be added to the total cost of the purchase

- Click 'Save'

The tax will be added to the tax list.

- Check or un-check the 'Status' box to enable/disable existing taxes

- All enabled taxes will be available for inclusion in modules like 'Products' and 'Services'

Edit a tax

- Click the cog icon then 'CRM Settings'

- Place your mouse cursor on a tax and click the pencil icon beside it

- Change tax name, value and status as required

- Click 'Save'

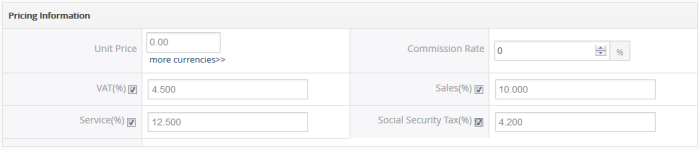

Include Taxes in Products and Services

While creating a product or a service, you can configure taxes in the 'Pricing Information' block:

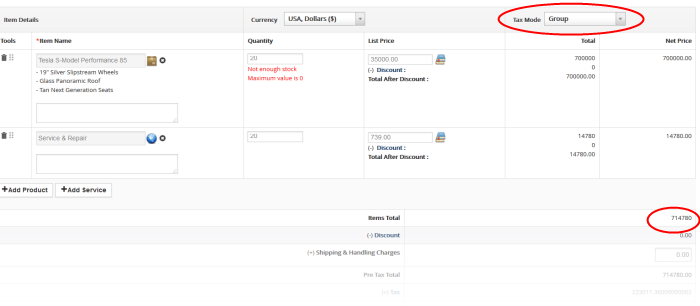

- You can select 'Group' tax mode while creating an invoice, sales order, purchase order or quote. Tax values will be automatically displayed and added to net total.

- To set the tax values of particular product(s), set the tax mode as 'Individual'.

See Add

a Sales Order and Add

a Purchase Order for more details.